Roblox Venture Capital: Gaming Industry Business

Roblox, a global online platform that brings people together through play, has evolved far beyond a simple gaming experience. What began as a sandbox-style game builder has now transformed into a sprawling ecosystem of creators, developers, and entrepreneurs. As its influence grows, so too do the opportunities for investors—particularly those involved in venture capital seeking to back what many see as the next generation of the gaming and metaverse industry.

TLDR (Too long, didn’t read): Roblox isn’t just a game—it’s a dynamic platform supporting a vast creator economy. Its open infrastructure, user engagement levels, and monetization tools make it an attractive target for investors. Venture capitalists are increasingly taking notice, funding studios and tools built around Roblox. The platform’s trajectory hints at long-term growth, not only in gaming but in the broader metaverse and digital economy spaces.

The Rise of Roblox as an Investment Platform

Table of Contents

Roblox has uniquely positioned itself at the intersection of gaming, social interaction, and user-generated content. With over 66 million daily active users as of early 2024 and billions of hours spent on the platform monthly, Roblox has created an environment where players and creators can interact in immersive and monetized experiences. For venture capitalists, these metrics are more than just numbers—they represent a rich ground for scalability and innovation.

Unlike conventional gaming studios, Roblox doesn’t develop most of the content on its platform. Instead, it offers tools and a marketplace for independent developers to build their own games—called “experiences”—and monetize them through virtual goods, subscriptions, and other in-game transactions. This separation between platform and content creator is a compelling marker for venture capital interest.

Why Roblox Attracts Venture Capital

Several aspects of Roblox make it particularly attractive to venture capital firms:

- Creator Economy Infrastructure: Roblox supports a robust ecosystem that pays hundreds of millions of dollars annually to creators, making it fertile ground for new developer studios and associated services.

- Scalability: Roblox experiences can scale rapidly due to the platform’s global reach and cross-device compatibility.

- Low Barriers to Entry: Developers don’t need significant capital or teams to get started, making it easier for VCs to make early-seed bets with high upside potential.

- Built-in Monetization: Through Robux (the platform’s currency), there are multiple, measureable revenue streams that make passionate developer teams sustainable businesses.

Top-tier VC firms like Andreessen Horowitz (a16z), Makers Fund, and BITKRAFT Ventures have already made investments in startups focused solely on building within the Roblox ecosystem or creating tools and services around it.

Case Study: Gamefam

Gamefam, a development studio born within Roblox, received multi-million dollar investments from venture firms to scale its suite of games. With notable franchises like “Twilight Daycare” and partnerships with major IP holders like SEGA and Mattel, Gamefam exemplifies how venture backing is capable of turning Roblox-based projects into serious business endeavors.

The Emergence of Roblox-Focused Startups

With the increasing monetization potential on Roblox, a new wave of companies is forming with a singular goal: to operate, grow, or support games on Roblox. This includes:

- Development Studios: Indie teams or organized entities creating and operating popular games within Roblox.

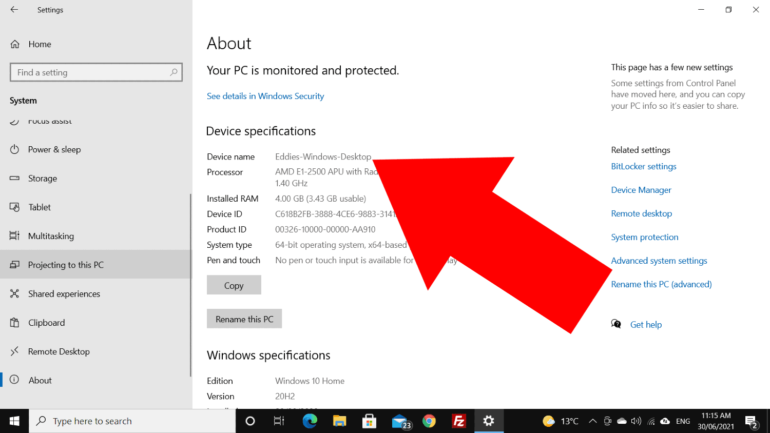

- Analytics Platforms: Tools to help developers track performance metrics, monetization trends, and user behavior on Roblox games.

- Marketing Agencies: Services that help Roblox developers reach more users through influencer engagement, SEO, and in-game marketing strategies.

- Service Providers: Companies offering backend services, such as cloud infrastructure or content moderation solutions, optimized for the Roblox engine.

Some of these startups have already exited to larger gaming and tech firms, indicating a positive trend for early investors. Others are generating real revenue through profitable games or SaaS products for creators.

Risks and Considerations for Investors

Despite the enthusiasm, the Roblox-centric segment of the venture capital world is not without its challenges.

- Platform Dependence: Businesses built entirely on one platform can be vulnerable to policy changes, algorithm shifts, or moderation rules by Roblox Corporation.

- Trend Volatility: Much like other forms of entertainment, what’s popular on Roblox can change unpredictably, affecting revenue forecasts.

- Demographic Concentration: A significant portion of Roblox’s audience consists of younger players, potentially limiting game content types and monetization strategies.

- Regulatory Oversight: Child safety, in-game spending, and creator compensation are under increasing scrutiny from global regulators.

Any venture capital activity in this space must account for these variables through proper due diligence and diversification.

Venture Capital Strategies and Focus Areas

To mitigate risks and maximize returns, venture capitalists entering the Roblox ecosystem often pursue a diversified strategy, such as:

- Backing multiple development studios rather than a single flagship game.

- Investing in infrastructure startups—like payment processors or analytics platforms—for long-term utility income.

- Exploring cross-platform potential where Roblox IP can be translated into web3, mobile gaming, or traditional gaming markets.

- Partnering directly with Roblox developers to fund sponsored experiences for brands or events.

In doing so, investors are not just betting on a single game’s success, but on the increasingly robust marketplace surrounding Roblox as a platform.

The Broader Implication: Roblox and the Future of the Metaverse

Roblox’s work in immersive 3D worlds positions it well to serve as a foundational layer of the so-called “metaverse”—a persistent, shared digital universe. While the term “metaverse” has been overused in recent years, Roblox may offer one of the few practical, monetized forms that exists today. The platform already boasts:

- Avatar-based social interactions

- Persistent world-building tools

- Virtual marketplaces

- Support for brand integrations such as concerts, film promos, and product launches

For venture capitalists thinking long-term, this aspect of Roblox makes it even more attractive. A stake in Roblox-related companies today could equate to early positioning in tomorrow’s digital economy.

Conclusion

In the ever-changing world of interactive entertainment, Roblox stands out as a powerhouse platform that combines the energies of creators, players, and investors. For venture capitalists, it’s not just a portal to gaming—it’s a gateway into a vibrant digital creator economy and a cornerstone of the evolving metaverse.

While not without risks, the potential upside of investing in companies building within or around the Roblox platform is too promising to ignore. From indie developers to SaaS startups and beyond, Roblox ventures are fast becoming a serious and lucrative domain for forward-thinking capital.

For those eyeing the future of gaming, digital economies, and immersive social networks, Roblox presents an over-performing investment frontier—and we are only beginning to see its full scope.